Supply Chain Financing

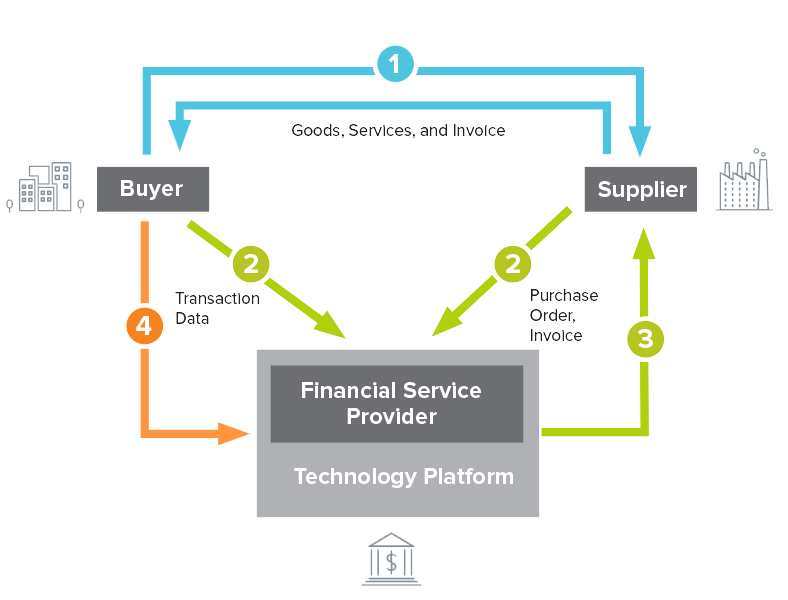

Our financing programs can support facilities based on payables, receivables, and inventory.

Using factoring, purchase order funding, inventory lending, and other structured trade finance techniques, our supply chain finance programs help align the needs of both buyers and sellers and minimize risk across the supply chain.

We can finance all the periods above using:

Vendor financing

For firms with solid financials, HCH can arrange vendor finance programs (also known as “reverse factoring” or “payables financing”). Often structured with “off-balance sheet” treatment for our client, these arrangements can be a true “win-win” offering our client’s vendors greater liquidity at a lower interest cost while allowing our client longer payment terms.

Import financing

In combination with factoring your receivables, HCH can help you import/purchase additional pre-sold product from your vendors. These arrangements are a particularly good fit for very high-growth or seasonal businesses.

Inventory financing

For clients dealing in goods that have a large and “liquid” market and holding goods in reputable third party warehouses, HCH can arrange financing against the standing inventory. This inventory financing is typically arranged with conditions on the advance rate and tenor of funding, and must include sound backup liquidation planning.

Benefits of our financing programs

Our programs allow you to optimize your working capital by providing solutions to you and your upstream and downstream partners. For instance, you can extend your payment terms and avoid discrepancies and fees associated with letters of credit and your suppliers benefit from an on-demand pool of liquidity, lower borrowing costs, faster funding, and a higher advance rate.

Benefits of Invoice Factoring

HCH can solve short-term cash flow issues by purchasing your company’s invoices in exchange for an advance of up to 85% of the total invoice value. We then collect the full amount from your customer upon invoice maturity. Once the invoice is paid in full, we send you the remaining balance.

- You get paid within 24-48 hours of invoice submission instead of weeks or months, or even faster in some cases

- Our services are not loans so, for many companies, our financing doesn’t show up on their balance sheet as debt

- We primarily finance based on the quality of your customers’ credit, not based on your financials.

- Our financing is scalable and can grow with your company

- You have peace of mind as we monitor the credit worthiness of your customers You can offer longer payment terms and therefore compete for larger buyers

- The application and set-up process are faster and easier than when applying for a bank loan

- Our local experts comply with the regulations of each country we operate in and offer appropriate services such as currency regulation control

Benefits of Import Financing

In addition to factoring your export account receivables, HCH can also finance your full supply chain. Our supply chain finance programs can support facilities based on payables, receivables, and inventory. Using purchase order funding, inventory lending, letters of credit, and structured guarantees, our financing helps align the needs of both buyers and sellers.

- Paperwork is simplified as payment is made to one entity while dealing with multiple suppliers

- We provide funding to foreign suppliers based on your creditworthiness and financial strength

- Your suppliers receive early payment at a lower cost as you can leverage your off-balance sheet credit

- Your suppliers receive additional cash flow allowing them to provide consistent supply and increase their volume of production

- Your suppliers can give favorable payment terms/you can extend your payment terms

- Your suppliers achieve better financial positions as you can take trade debt off their balance sheet

- Your suppliers benefit from fast funding and high advance rates

- You can work with smaller suppliers and contract directly with them; your available range of suppliers is broader